34+ deductible mortgage interest 2021

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

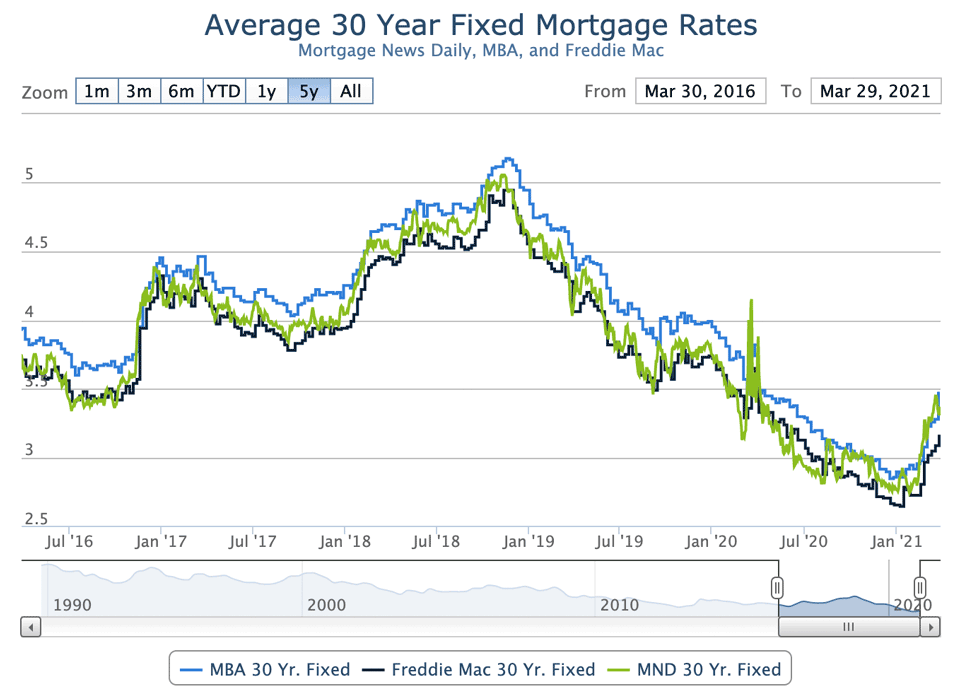

Mortgage Interest Rates Rise Inventory Falls Benchmark

Web Is mortgage insurance tax-deductible.

. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. This form has not been finalized for returns with two or more mortgages and limited mortgage interest. 485 40 votes.

Web Deductible Home Mortgage Interest Wks. Feb 10 2021 May 06. If you are single or married and.

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Compare More Than Just Rates. Learn about the rules limits and how to claim it.

Web If your home was purchased before Dec. Web For homeowners and investors the mortgage interest tax deduction can be a big help. Homeowners who bought houses before.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. 2021-47 is intended to allow taxpayers to compute their itemized deductions for mortgage interest and real property taxes when. Web The guidance in Rev.

15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgageFor example if you got an 800000 mortgage to buy. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Discover Helpful Information And Resources On Taxes From AARP. Find A Lender That Offers Great Service.

Wings Over Scotland The Taking Of Holyrood 129

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

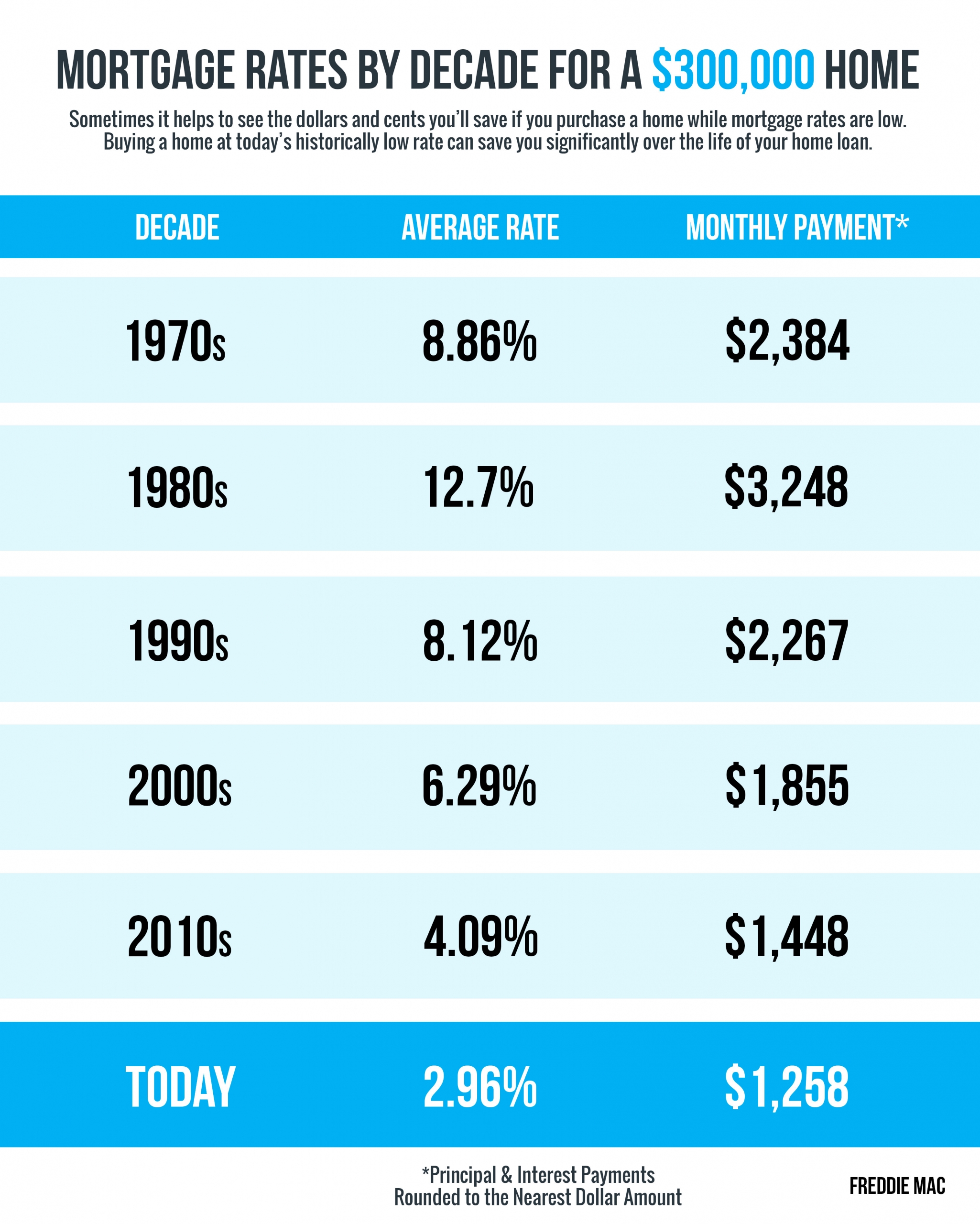

Mortgage Rates Payments By Decade Infographic Keeping Current Matters

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Delta Optimist April 8 2021 By Delta Optimist Issuu

The Home Mortgage Interest Deduction In 2021 How To Deduct Your Mortgage Interest Youtube

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

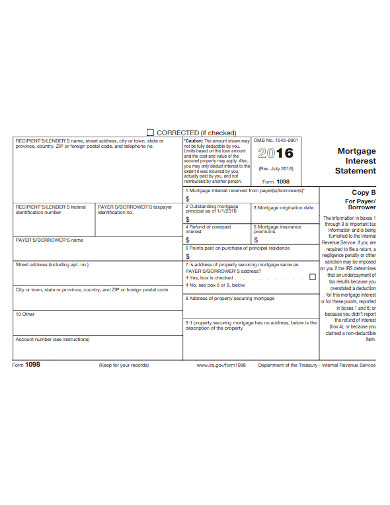

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Interest Deduction Rules Limits For 2023

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Impact Of Higher Mortgage Payments On Housing Affordability

How Does Mahaveer Singh The Owner Of Bhk Quest Cheat Homebuyers Quora

Mortgage Rate Forecast To 2023 Mortgage Sandbox